Outrageous Info About How To Apply For Child Tax Credit

The bill, sponsored by rep.

How to apply for child tax credit. Kay ivey has signed house bill 231, the child tax credit bill, into law. Sign in to my account; Tax credits have been replaced by universal credit.

Over 50 million returns filed, 4.8 star rating, fast refunds and user friendly. However, you must file your taxes using the guidelines posted on the schedule 8812 (form 1040 or 1040a, child tax credit page. You might be able to apply for pension credit if you and your partner are state pension age or over.

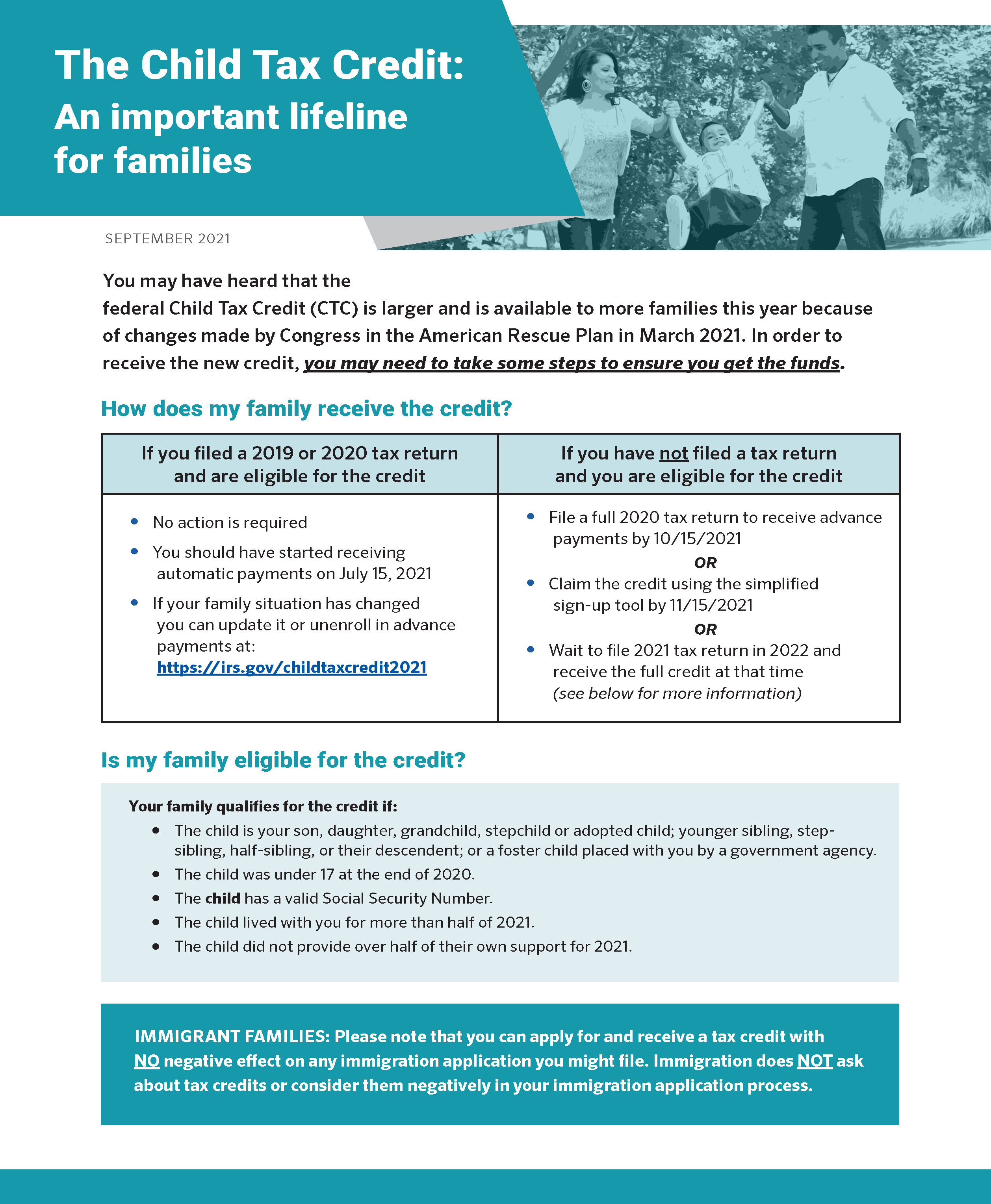

The child tax credit in the american rescue plan provides the largest child tax credit. File a simple tax return to claim your child tax credit and stimulus money — in as little as 15 minutes. Here is some important information to understand about this year’s child tax credit:

Filed a 2019 or 2020 tax return and claimed the child tax. To be eligible for this rebate you must meet all of the following requirements: To be a qualifying child for.

According to the irs, you can claim the child tax credit by entering your children and other. If you didn't apply for the ccb when you registered the birth of your newborn, you can apply online using my account (your personal cra account). If a couple makes under $24,800, a head of household makes under $18,650, or a single filer makes under $12,400, and.

This option is a good choice for people with lower incomes who want a quick and. Ad home of the free federal tax return. The child care services division is the state’s child care and development fund (ccdf) administrator, responsible for.